How Personal Loans Can Help Consolidate Debt

Outline and Why This Topic Matters

– Section 1: A roadmap for understanding personal loans, debt consolidation, and how they connect to everyday finance decisions.

– Section 2: Core features of personal loans—rates, terms, fees, qualifications—and how to interpret offers.

– Section 3: How consolidation streamlines multiple balances, with math-based illustrations and realistic trade-offs.

– Section 4: Repayment strategies, amortization insights, and tactics to shrink total interest paid.

– Section 5: Application timeline, documentation checklist, common pitfalls, and a concise conclusion to act on.

Debt often builds like layers of sediment—one card for an emergency, a store promo here, a balance transfer there—until the monthly picture becomes foggy. Personal loans can cut through that fog by turning a handful of revolving balances into one installment with a defined end date. That clarity matters: revolving credit typically has variable rates and minimum payments that stretch the timeline, while installment loans use a fixed schedule that chips away at principal every month. For many households, the pulse of financial stress is not just the total owed, but the unpredictability of payments across different due dates and rates.

Before choosing any path, it helps to know what success looks like. A good outcome is not measured only by a lower monthly bill; it involves fewer due dates, a shorter payoff horizon, and a reduced interest burden over the life of the debt. This article follows a practical arc: we define key terms, compare common scenarios, quantify outcomes with simple math, and end with an actionable checklist. You will see when consolidation can speed up your payoff, when it might not, and how to evaluate offers with a calm, methodical approach. Think of the sections ahead as a map: you choose the route, but the landmarks—rates, fees, timelines—help you avoid detours that cost time and money.

Personal Loans 101: Features, Costs, and Fit

Personal loans are typically unsecured installment loans: you borrow a lump sum and repay it in equal monthly installments over a fixed term, often 24 to 84 months. Rates are usually fixed, so your payment stays predictable. Lenders assess factors like credit history, income stability, debt-to-income (DTI) ratio, and existing obligations. Terms, fees, and approval criteria vary, but the building blocks are consistent: principal, interest rate (APR), repayment term, and any origination or late fees. Because the schedule is fixed, each payment includes both interest and principal, steadily reducing what you owe.

Cost clarity is the main advantage over revolving credit. With a defined term, you can forecast when you will be debt-free, which helps with budgeting and goal setting. Sample math illustrates the mechanics: a $15,000 loan at 12% APR for 48 months carries a monthly rate of about 1.0%. The estimated payment is roughly $396, putting total interest near $4,008 over four years. If you were paying similar balances on multiple cards at higher, variable APRs, the total interest could be materially higher—especially if you only make minimums that barely reduce principal.

Fees deserve attention. Origination fees can range from 0% to several percentage points and are often deducted from the disbursed amount. Prepayment rules differ; some lenders allow extra payments without penalty, while others may have restrictions. Be sure to confirm whether autopay discounts are offered and how late fees are assessed. Spread your evaluation across the full picture: APR, fees, payment amount, and total interest. When comparing offers, look for language that signals market alignment, such as competitive rates, but always review the disclosures and the total cost of borrowing before you commit.

Fit matters. Personal loans can be a strong tool when you want payment certainty, a fixed payoff date, and a simplified monthly routine. They are less suitable if the new payment would be unaffordable, if fees outweigh savings, or if you anticipate needing revolving flexibility again. A clear-eyed assessment of your cash flow—how much you can safely commit monthly—prevents strain and helps you use the loan as a stepping-stone rather than a stumbling block.

Debt Consolidation Mechanics: Turning Many Bills into One Plan

Consolidation means using one new loan to pay off several existing debts, leaving you with a single payment and, ideally, a lower overall interest burden. The potential wins are fewer due dates, a fixed term, and a predictable payoff timeline. The trade-offs include any origination fees on the new loan, a possible higher monthly payment than your combined minimums, and the discipline required to avoid re-accumulating balances on newly freed credit lines. The math will tell you if the move is advantageous.

Consider a simplified example. Say you have $8,000 at 22% APR, $4,000 at 27% APR, and $3,000 at 19% APR. The approximate first-month interest on those balances is about $147, $90, and $48 respectively—roughly $284 in interest before reducing principal. If your combined minimums are around $375, only about $91 initially goes toward principal, and progress is slow. Now compare with a $15,000 consolidation loan at 14% APR for 36 months. The estimated monthly payment is about $513, which is higher than the combined minimums but fully amortizes the debt in three years. Total interest would be near $3,468, and every payment steadily knocks down principal.

What if your credit profile supports stronger pricing? Low APR options may be available to qualified borrowers (terms apply). Conversely, if your credit is developing, your offered APR might be higher, shrinking or eliminating the savings from consolidation. That is why a side-by-side comparison of total costs is essential: include origination fees on the new loan and factor in any promotional rates or balance transfer fees you would otherwise use. If the numbers show a lower total interest and a realistic monthly payment, consolidation can transform a maze of balances into a single, navigable path.

Two practical safeguards complete the picture. First, consider closing or reducing limits on paid-off accounts if you worry about re-spending, while understanding the potential short-term credit score effects. Second, set up an emergency buffer—ideally one month of expenses to start—so you do not need to lean on credit if an unexpected bill arrives. Consolidation is not a magic wand, but paired with a tighter budget and mindful habits, it can be the clean slate that accelerates your financial reset.

Cost Comparisons and Repayment Strategies That Save Real Money

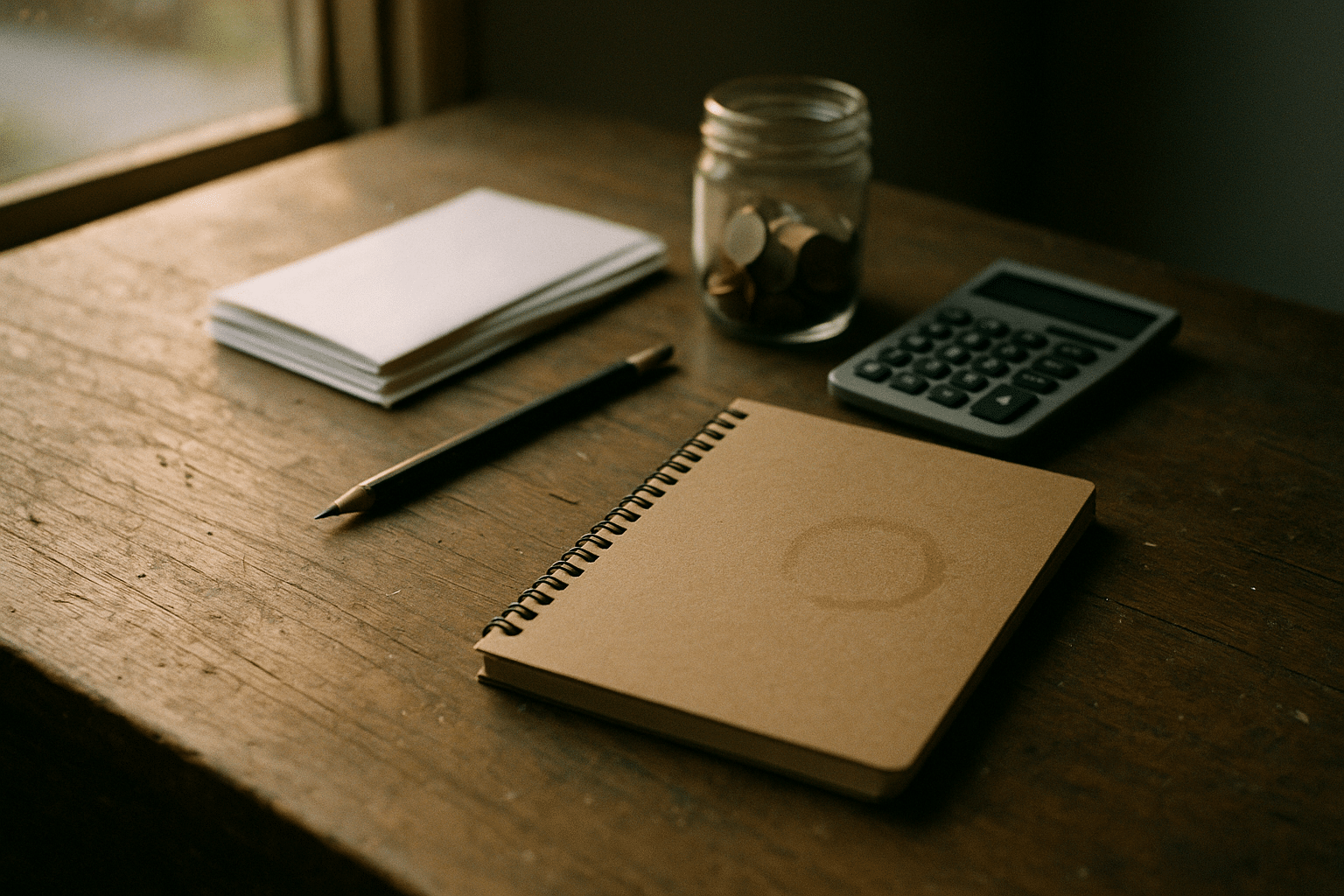

Comparing options starts with apples-to-apples math. Line up your current debts and list, for each: balance, APR, minimum payment, and whether the rate is fixed or variable. Next, model the proposed loan: principal, APR, term, and any fees. Estimate monthly payment using a basic amortization formula or a calculator, and tally total interest across the life of the loan. Because installment loans front-load interest, paying even a small amount extra monthly reduces total interest and shortens the term. This matters whether you consolidate or not.

Strategy choices help you finish faster. Avalanche targets the highest APR first, minimizing total interest; snowball targets the smallest balance to score early wins and momentum. If you consolidate, you can still apply these mindsets by adding focused extra payments toward principal each month. Consider these practical tactics embedded in everyday budgeting:

– Round up your payment by $25–$100; the compounding effect across dozens of months is meaningful.

– Switch to biweekly payments if permitted; 26 half-payments equal roughly one extra full payment per year.

– Automate a modest monthly “sweep” of surplus cash—refunds, side income, or expense reductions—toward principal.

– Revisit your insurance, subscriptions, and utilities annually to free up dollars that can bolster debt payoff.

Loan structures can also help. Some lenders offer flexible repayment options, including the ability to add extra principal without penalty or to change due dates to align with pay cycles. If you receive variable income, choose a payment amount that leaves breathing room during slower months and commit any upside to additional principal during strong months. Track your progress visibly—on a whiteboard or app—so the declining balance becomes a motivational scoreboard rather than an abstract number on a statement.

Finally, weigh alternatives in case a personal loan is not the right fit. Balance transfer offers with intro rates may help if you can pay down rapidly before the promo ends and if transfer fees are modest. Debt management plans through accredited counselors can secure interest concessions, though you will close cards and commit to a strict plan. Whichever path you choose, anchor the decision to total cost, timeline, and sustainability, not just the allure of a lower initial payment.

From Application to Action: Timeline, Tips, and Conclusion

Qualifying well starts with preparation. Check your credit reports for accuracy, and understand your score tiers; stronger credit usually means lower APRs and broader options. Calculate your debt-to-income (DTI) ratio by dividing total monthly debt payments by gross monthly income; a DTI under roughly 36% is often viewed more favorably, though thresholds vary. Gather documentation in advance to avoid delays: government ID, proof of income (pay stubs or bank statements if self-employed), employer details, and a list of debts to be paid off at funding. Many lenders let you prequalify with a soft inquiry, helping you compare estimated terms without affecting your score.

Expect a straightforward path from offer to funding. After prequalification, you submit a full application, verify identity and income, and review disclosures. You may be asked to connect financial accounts electronically or upload statements. If approved, funds can arrive quickly, and some providers will pay creditors directly to streamline consolidation. Marketing often highlights a quick review process, but timelines vary; build a cushion of a few days to a week when coordinating payoff dates to prevent interest from accruing on old balances longer than expected.

To protect the benefit of consolidation, align your habits with the new plan. Freeze recurring expenses that tend to creep—unused subscriptions, takeout frequency, convenience buys—and redirect those dollars to principal. Consider these closing tips as you move from decision to action:

– Lock in autopay and track your first three payments to confirm amounts and dates are accurate.

– Set calendar reminders for quarterly check-ins to evaluate progress and add extra principal when possible.

– Keep a starter emergency fund so surprises do not send you back to revolving credit.

– If your credit profile improves, revisit offers after six to twelve months to assess potential rate or term adjustments via refinance.

Conclusion: Personal loans and consolidation can transform a tangle of balances into one clear, time-bound plan. The approach works best when the monthly payment is comfortably affordable, total interest drops versus the status quo, and you commit to avoiding new revolving debt while paying down the installment. With measured preparation, realistic numbers, and steady follow-through, you turn financial noise into a single, confident note—progress you can see on a calendar and feel in your budget.