Understanding Credit Card Benefits: What to Look For

Outline

– Framing credit cards as financial tools, not traps; how they impact credit and cash flow

– APRs, fees, and promos explained with clear math and practical examples

– Matching card features to personal goals and spending patterns

– Comparing offers realistically and reading the fine print with confidence

– A responsible-use plan and closing checklist to keep momentum

Credit Cards in Your Financial Toolkit: Purpose, Protections, and Pitfalls

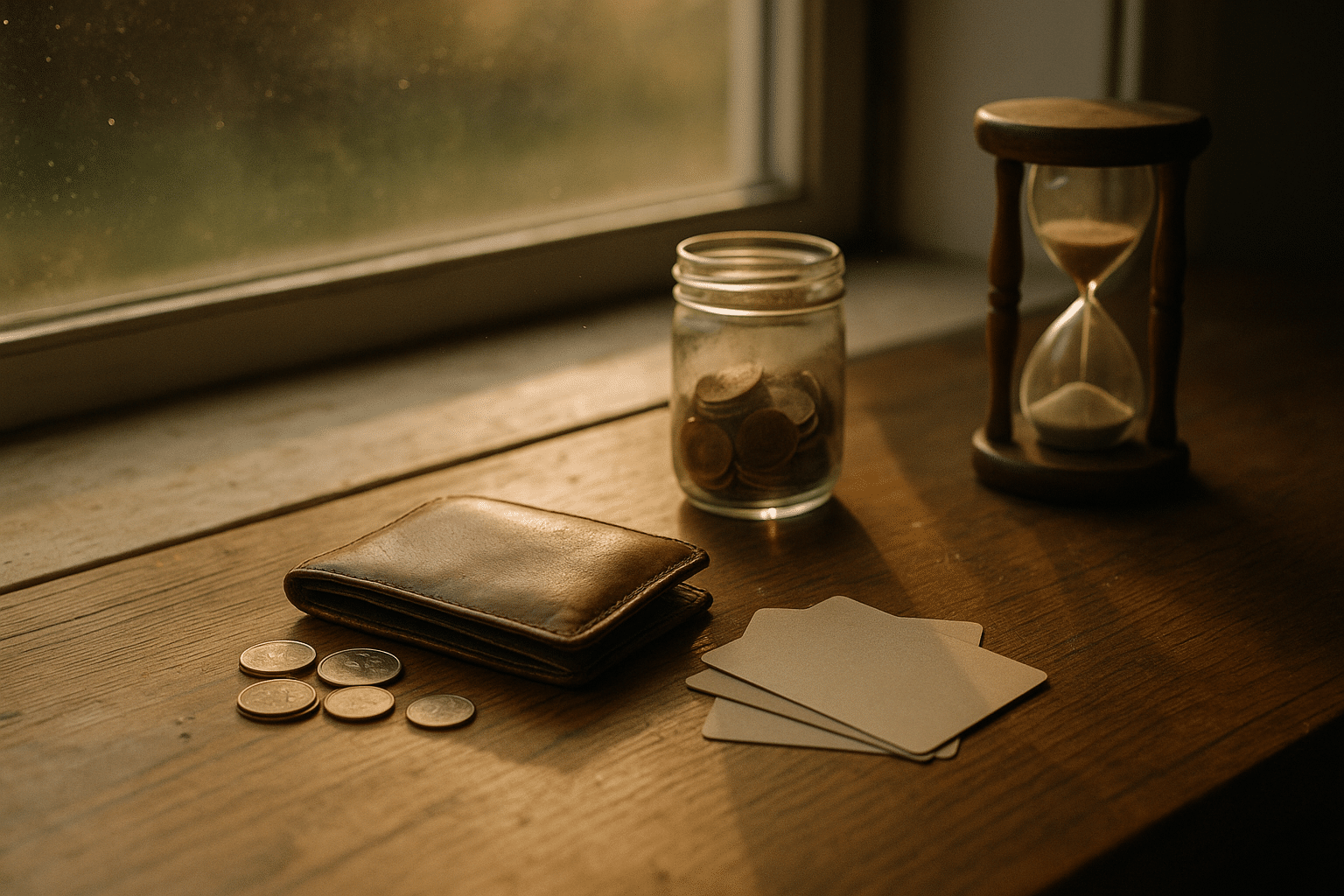

Used thoughtfully, a credit card can be a multi-tool in your wallet: a short-term bridge for cash flow, a way to build credit, and a payment method with notable consumer protections. The key is intent. If your goal is to build a strong credit profile, two habits matter most in common scoring models: paying on time (a large share of your score) and keeping balances low relative to limits (credit utilization). A widely cited guideline is to keep utilization under about 30% overall, and lower is often better. These choices ripple through your broader finances by lowering borrowing costs across loans and insurance where credit-based pricing is used.

Protections are part of the value. Under U.S. law, liability for unauthorized charges on a credit card is generally limited, and many issuers voluntarily waive even small amounts to support fraud resolution. Disputes over billing errors and undelivered goods often benefit from chargeback rights, which can be stronger than protections you get with some direct bank transfers. That safety net, paired with alerts and digital controls, helps you spot issues early and act fast. However, protections are not a license to overspend—interest can quickly erase any rewards or conveniences if balances roll over month to month.

It’s easy to be enticed by convenience when the application advertises a quick review process, but slow down enough to read eligibility criteria, fees, and how your proposed limit fits your budget. Consider creating a pre-commitment plan before applying: set your monthly spend cap, decide whether you’ll automate full payments, and identify how this new line will affect your utilization. Think through how the card will integrate into your existing system of bills to avoid missed due dates. A deliberate approach helps you capture the genuine advantages—fraud protection, clear record-keeping, and potential rewards—without falling into the trap of revolving high-interest debt.

Practical starting points:

– Map fixed bills and variable expenses before adding a new card.

– Automate at least the minimum due, then aim for full balance payments.

– Set balance alerts at 20%, 30%, and 50% of your limit to protect utilization.

– Review statements monthly for accuracy and category trends you can adjust.

APR, Fees, and Promotional Windows: What the Math Says

Interest rate mechanics determine whether a credit card is a helpful bridge or an expensive anchor. Variable APRs typically float with market benchmarks, and in recent years average rates on accounts that incur interest have hovered above the low-20% range according to public central bank data. That means a $1,000 balance left to revolve can add roughly $18–$22 in interest in a single month depending on the daily periodic rate and compounding, before you make new purchases. The math accelerates if you pay only the minimum, stretching balances across many months while total interest mounts.

Promotional windows can shift the equation. You’ll sometimes see 0% intro APR available (terms apply) on purchases, balance transfers, or both. These offers can be useful for financing a planned, necessary expense or consolidating higher-rate debt, provided you know exactly when the clock runs out and what fees apply. Balance transfer fees commonly run a few percentage points of the amount moved; payback plans should account for that upfront cost. When the promo ends, the standard APR kicks in based on your credit profile and market rates, so plan to retire the balance well before that date.

Fees deserve equal attention. Common categories include annual fees, foreign transaction fees, balance transfer fees, cash advance fees, late fees, and returned payment fees. Each has a different trigger and cost profile:

– Annual fees may be worthwhile if benefits and rewards outweigh the expense.

– Foreign transaction fees can add a few percent to overseas purchases.

– Cash advances typically start accruing interest immediately and at higher rates.

– Late fees and penalty APRs can raise your costs and dent your credit history.

One way to pressure-test an offer is to run a break-even exercise. Suppose you plan a $1,500 purchase and can repay $250 per month. With a six-month promotional period and a 3% transfer fee, you’d pay $45 up front but potentially $0 interest if you clear the balance in time. Without a promo and at a 22% APR, you’d pay roughly $90–$110 in interest over six months on a similar balance depending on payment timing. Simple comparisons like this make the true cost visible—and help you commit to payoff schedules that preserve your savings.

Pick Features That Match Your Goals: Rewards, Security, and Flexibility

Before applying, get clear on your objective. Are you building credit from scratch, smoothing cash flow for recurring bills, seeking travel perks, or consolidating prior balances? Different card types emphasize different strengths. A secured product may help establish history if your file is thin. A flat-rate rewards structure can simplify everyday spending. Category-based rewards can be valuable if your budget regularly leans toward groceries, transit, or utilities. For debt consolidation, a product focused on low or promotional rates—not flashy perks—may be more appropriate. Matching the tool to the task keeps rewards honest and avoids “earning” points on balances that quietly accumulate interest.

Look beyond marketing headlines to daily usability. Strong account controls—real-time notifications, transaction freezing, and virtual numbers—add practical security. Clear redemption paths matter as much as headline earn rates; rewards that require hoops, blackout dates, or devaluation are less useful. Consider how earnings align with your life stage: a commuter may value transit bonuses, while a frequent online shopper might prefer purchase protection features. If you share finances with a partner, authorized user options can centralize spending and build credit history for both parties when used responsibly.

Repayment flexibility is another pillar. Life is not perfectly predictable, so products that allow flexible repayment options—such as the ability to schedule multiple payments per month, adjust due dates, or choose plan-like installments on larger purchases—can help you stay on track. Still, flexibility is valuable only if you use it to accelerate payoff rather than to justify higher balances. A few rules of thumb help:

– Aim to pay in full every cycle; treat rewards as a bonus, not a reason to spend.

– If you must revolve, pre-plan the payoff date and amount before you swipe.

– Keep new applications spaced out to protect your credit score from multiple inquiries.

Consider an example. If your top priority is stabilizing monthly cash flow, a straightforward card with predictable earnings and a robust mobile app for alerts may outperform a premium rewards package you rarely tap. If your credit is developing, the path from secured to unsecured—paired with on-time payments and low utilization—can lower overall borrowing costs over time. The right fit is personal, measurable, and aligned with goals you can actually track month to month.

How to Compare Offers Like a Pro: Signals, Fine Print, and Negotiation

Comparing cards is easier when you use a consistent framework. Start with the core financial levers: APR range, fees, and whether any intro windows apply. Then evaluate rewards value and redemption friction, purchase protections, and digital controls. Check if prequalification is available with a soft inquiry, which can help you gauge likely terms without affecting your credit. The goal is to narrow to a short list that fits your score tier and spending patterns before submitting a full application.

Consider interest and fee trade-offs first. Products that advertise competitive rates can save serious money if you ever carry a balance, even briefly. If a card has an annual fee, estimate your expected rewards and benefits in currency terms over a year and subtract the fee to get a net number. For example, if you spend $1,000 a month and earn an average of 1.5% back, that’s about $180 per year—enough to offset a modest annual fee if you also value added protections. If rewards redeem below face value or require complex transfers you won’t use, discount your estimate accordingly.

Now read the fine print with intention. Look for how the grace period works, the definition of a late payment, and what triggers a penalty APR. Understand balance transfer timelines and whether new purchases accrue interest immediately when a transfer is active. Check foreign usage policies, contactless and virtual card options, and how disputes are handled. Then test two or three finalists with realistic scenarios:

– Scenario A: You pay in full every month; which product nets higher value after fees?

– Scenario B: You revolve $800 for two months once a year; how do interest and fees compare?

– Scenario C: You need an emergency repair; does a promotional plan improve cash flow safely?

If you already hold a card, consider calling customer service to request a reduced APR, a product change, or a credit limit reassessment after a strong payment streak. While outcomes vary, issuers sometimes accommodate reasonable requests—especially if your income and credit have improved. Keep records of your spending and payments; a tidy track record makes your case stronger. Ultimately, the right choice is the one that keeps your costs predictable, your protections strong, and your budget moving toward specific goals.

Responsible Use and Next Steps: A Practical, Repeatable Plan

Good systems beat good intentions. Start with a two-account method: route predictable bills to one card you always pay in full, and keep a second card for variable purchases you monitor closely. Pair this with a weekly five-minute review ritual to categorize transactions, spot anomalies, and verify that you’re on track for a full payoff. Add calendar reminders a few days before due dates and enable autopay for at least the minimum to avoid accidental late fees. These small habits form a protective fence around your credit and keep surprises rare.

Build a cushion to break the debt cycle. A modest emergency fund—often one to three months of essential expenses—reduces the likelihood that a single car repair or medical bill pushes a balance into months of interest. If you’re carrying existing debt, consider a structured plan. List balances, APRs, and minimums; pick either a highest-interest-first (avalanche) or smallest-balance-first (snowball) strategy; and automate extra payments to the target account while paying minimums elsewhere. Revisit progress monthly and celebrate visible milestones to reinforce the habit loop.

Track three metrics that predict healthier outcomes:

– Payment timeliness: 100% on-time payments safeguard your score and avoid penalties.

– Utilization: keep overall and per-card ratios comfortably below your limit thresholds.

– Net monthly interest: measure it; what gets measured gets managed, and your goal is zero.

Finally, create a personal policy statement—a short note you keep in your budgeting app: “I only charge what I can clear by the due date, I review statements weekly, and I pause new applications unless they align with a specific, quantified goal.” This quiet script helps you resist impulse upgrades and one-time “limited offers” that don’t fit your plan. Over a year, the compounding effect of on-time payments, low utilization, and thoughtful redemptions shows up not only in your credit profile but in lower borrowing costs across your financial life. The payoff is tangible: steadier cash flow, more resilient savings, and the confidence that your card is working for you—not the other way around.