Understanding Credit Card Benefits: What to Look For

Outline

– Why credit card benefits matter: total cost, interest, rewards, and protections

– How to compare APRs and introductory offers without surprises

– Credit limits, utilization, and the link to your credit score

– Fees, perks, and policies that genuinely add value

– Practical strategies to manage and eliminate card debt

Introduction

Credit cards are powerful tools—multitaskers that can smooth cash flow, add security to purchases, and unlock value through perks. But the same tools can become costly if terms, fees, or interest are misunderstood. This article brings structure to the noise: we examine what to look for, how to compare key features, and how to build a plan that supports long-term financial health. Whether you are choosing your first card or optimizing a seasoned wallet, the goal is the same: clarity that leads to confident decisions.

Decoding Value: How Rates, Rewards, and Real-World Costs Interact

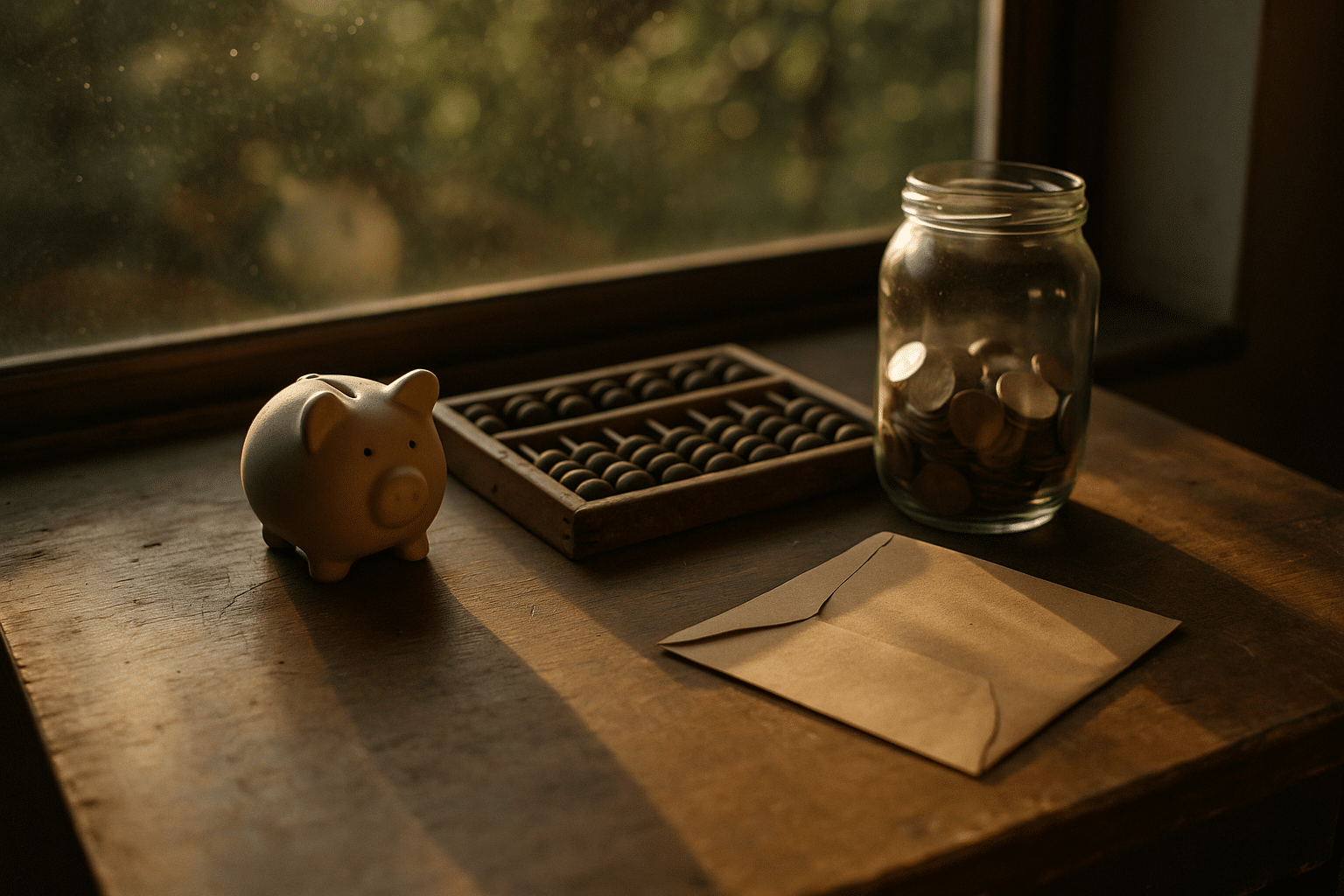

When evaluating a credit card, step back and calculate total value: the combination of interest, fees, and benefits you actually use. Advertised perks may feel exciting, but your net gain starts with the fundamentals. If you typically pay in full, fees and redemption rules determine your outcome. If you sometimes carry a balance, interest cost can quickly overshadow any points or cash back. That is why comparing cards that claim competitive rates matters; a few percentage points can translate into meaningful savings over a year.

Let’s ground this with simple math. Suppose you carry a $1,000 balance for three months at a 20% APR. The monthly rate is roughly 1.67%, so interest over three months is about $50 if you make small minimum payments. Scale that to $3,000 for six months and the cost rises into the hundreds. On the other hand, paying in full eliminates interest and puts all attention on fees and rewards. If an annual fee is $95 and your realistic yearly rewards are $150, your net benefit is $55—before considering insurance protections or foreign fees. The point is to measure your own pattern first, then map features to that reality.

As you compare, keep a running checklist:

– APR tiers: purchase, balance transfer, and cash advance (these often differ)

– Fee profile: annual, balance transfer (commonly 3%–5%), foreign transaction, late, and returned payment

– Redemption structure: minimum thresholds, transfer partners, and expiration rules

– Protections: purchase protection, return assistance, extended warranty, trip delay, and rental coverage

– Access and support: mobile tools, dispute resolution speed, and account alerts

Notice the order: cost, then value-add. By filtering choices this way, you avoid chasing flashy features while overlooking the quiet math that drives outcomes. Cards with straightforward terms and competitive rates help reduce friction, while clear protections can save a purchase when something goes wrong. The right combination is the one that fits your spending pattern, not the one with the most bullet points on a brochure.

APRs and Introductory Offers: Using Promotions Without Getting Burned

Interest is the price of carrying a balance, and it varies by transaction type. Purchase APRs cover everyday spending, balance transfer APRs apply when you move debt from another card, and cash advance APRs typically sit at the higher end and start accruing immediately. In recent years, average purchase APRs in the United States have drifted above 20%, according to central bank statistics, which makes promotional windows especially appealing. Many cards highlight that 0% intro APR available (terms apply), usually on purchases, transfers, or both, for a defined period.

Promotions can be useful when managed intentionally. For example, transferring $3,000 to a card with a 0% window and a 4% transfer fee means an upfront $120 cost. If you retire that balance before the promo ends, your total interest can be far lower than leaving it on a higher-rate card. But there are caveats. Some offers feature deferred interest on certain purchases, where missing the payoff date can trigger retroactive interest on the entire amount. Others end earlier for late payments, and all will revert to a standard variable APR once the timer runs out.

To use promos wisely, adopt a “plan to zero” approach on day one:

– Divide the balance by the number of promotional months to set a monthly payment target

– Automate payments above the minimum to avoid timing errors

– Avoid new purchases that would mix with the transfer and accrue at a different rate

– Mark the end date on your calendar at least a month in advance for a final sweep

Remember, promotional terms vary by market conditions and credit profile. Read the disclosures, compute the all-in cost (including transfer fees), and confirm how payments are allocated if you carry multiple balance types. Used with intention, promos can bridge a cash-flow gap or accelerate a payoff plan. Used casually, they can become a revolving door that never quite closes.

Credit Limits, Utilization, and Your Score: Building a Strong Profile

Your credit limit and the way you use it influence both borrowing costs and future approvals. Most scoring models weigh payment history heavily (around one‑third of the score) and credit utilization substantially (often another third, give or take). Utilization is your balance divided by your credit limit, measured per account and in total. Keeping this ratio under 30% is a commonly cited guardrail; under 10% tends to be even more favorable for score momentum. That means a $5,000 total limit pairs well with balances kept below $1,500—ideally much lower by the statement close date.

Applications also leave hard inquiries, which can nudge scores down a few points temporarily. Many issuers provide prequalification tools or a quick review process online that estimates eligibility without a hard check, though final decisions generally require a full evaluation. If your profile is new or credit-thin, consider starting with a card designed for building history, then graduating to richer features after six to twelve months of on-time payments.

Practical steps to strengthen your profile:

– Pay on time, every time; even one 30‑day late mark can linger for years

– Pay down balances before the statement closes to reduce reported utilization

– Consider requesting a limit increase after several months of spotless behavior

– Keep older accounts open when feasible to preserve average age of credit

– Space out applications to allow scores and new accounts to season

These habits do more than lift a score; they lower costs. A stronger profile broadens access to higher limits and, often, better pricing tiers. If you are rebuilding after a setback, patience plus systems—calendar reminders, autopay for at least the minimum, and mid-cycle payments—create forward motion. Think of your credit file as a living résumé that updates monthly. Each statement period is a chance to publish a better result.

Fees, Perks, and Protections: Reading the Fine Print That Actually Matters

Beyond interest, the fee and benefit landscape shapes day-to-day value. Annual fees can be worthwhile if recurring credits or everyday multipliers exceed the cost. For international travelers, foreign transaction fees—often 3%—can eclipse any rewards, so verifying that line is essential. Late fees are another concern; they commonly land around $30–$40 and can jeopardize promo terms. Meanwhile, purchase protection, extended warranty, return assistance, and travel coverage can quietly save you money when plans go sideways. These benefits differ widely, so your personal usage patterns should guide which ones matter.

Some issuers also offer flexible repayment options that split large purchases into predictable installments for a modest fee. These plans are not a green light to overspend, but they can tame volatility if used sparingly and paired with an exit plan. Before enrolling, compare the effective cost to normal interest, verify whether the installment lowers your reported utilization, and confirm any impact on rewards or protections. As always, clarity beats complexity: simple, transparent structures reduce the odds of costly mistakes.

High-value features to scan for in the guide to benefits:

– Purchase safeguards: coverage for damage or theft within a short window

– Warranty extensions: typically add a year to eligible manufacturer coverage

– Travel protections: trip delay, lost bag assistance, and car rental collision support

– Dispute resolution: a clear path when a merchant fails to deliver

– Account tools: alerts, category tracking, and budgeting views to spot trends

One more angle: terms can change. Rising interest rate environments have led to upward adjustments in variable APRs and occasionally in fees. Keep a periodic calendar to re-read your agreement and benefit guides. If the economics shift out of your favor, adjust: request retention offers, switch to a no-fee product from the same family, or close rarely used accounts while considering the score impact. The fine print is not exciting, but it is the terrain on which real value is won or lost.

Mastering Payoff Strategies: From High-Interest Avalanche to Everyday Automation

Eliminating card debt is part numbers, part behavior. Two proven frameworks help: the avalanche method (target the highest APR first for maximum interest savings) and the snowball method (target the smallest balance first for faster psychological wins). Both require a steady surplus directed at a single account while paying minimums on the rest. The avalanche is typically more cost-efficient; the snowball can build momentum when motivation is the bottleneck. Choose the one you will stick with and automate it.

Consider a household with $5,000 spread over three cards at 24%, 21%, and 18% APRs. With $300 extra to allocate monthly, the avalanche sends most dollars to the 24% account until it is gone, then rolls that payment to the next highest rate. If you add a mid-cycle payment timed before the statement closes, you may also report lower utilization, adding a small score tailwind. An occasional windfall—tax refund, bonus, or a successful side gig deposit—accelerates the timeline if you resist lifestyle creep.

System design matters as much as strategy:

– Set autopay for at least the minimum on every account to prevent late fees

– Create a payment calendar keyed to statement close and due dates

– Use spending alerts and category limits to catch drift early

– Revisit your budget quarterly to reallocate savings to principal reduction

As balances fall, do not rush to close every account. Keeping a few older lines open can support utilization and average age metrics, which may lower your borrowing costs over time. If a card no longer earns its keep, product-change to a no-fee variant when possible. Keep records of your progress and celebrate milestones to sustain motivation. Debt freedom rarely arrives with fanfare; it shows up quietly, like sunrise through the blinds—one on-time payment at a time.

Conclusion: A Practical Path to Smarter Credit

Pick cards that match your habits, not your hopes. Anchor decisions in cost—APRs, fees, and the math of carrying balances—then layer in benefits you will actually use. Leverage promotions carefully, mind utilization, and automate good behavior. With a clear plan, measured comparisons, and steady execution, credit cards can be financial tools that safeguard purchases, smooth cash flow, and support long-term goals—without surprises.