Why Smart Drivers Avoid Refueling on Fridays

Introduction to Financial Planning and Fuel Costs

Financial planning encompasses a broad range of strategies aimed at managing your financial resources effectively. An often-overlooked aspect of personal finance is how everyday decisions, such as when to refuel your vehicle, can impact your budget. Refueling on Fridays, for example, can be more costly due to increased demand, a trend that mirrors the need for strategic financial planning in other areas of life. This article explores how the principles of financial planning can be applied to seemingly mundane tasks like refueling, offering insights into broader financial strategies that support long-term savings and financial health.

The Economics of Fuel Pricing

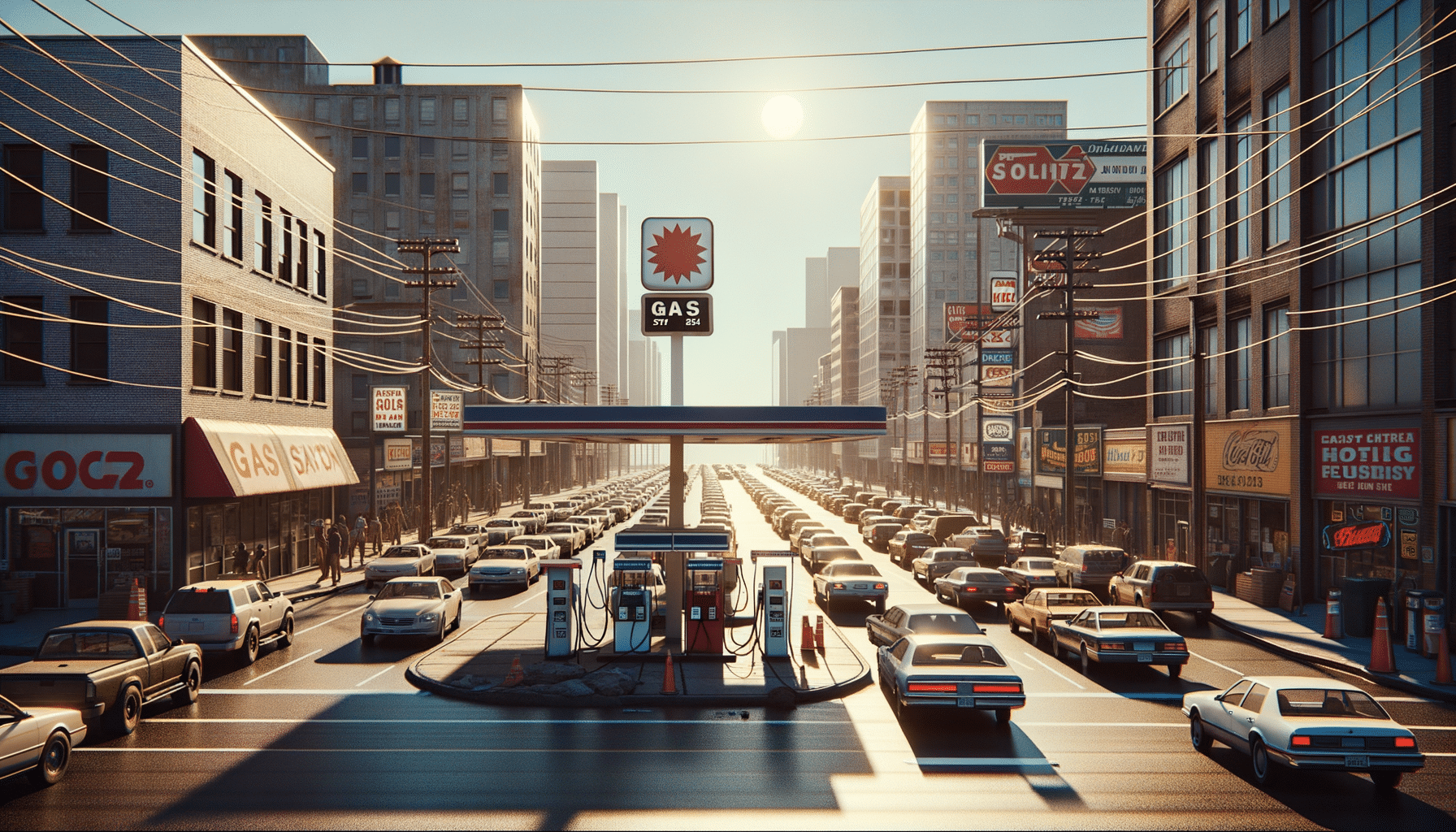

Fuel prices fluctuate based on various factors, including supply and demand, geopolitical events, and seasonal changes. Understanding these dynamics is crucial for making informed decisions about when to refuel. Typically, fuel prices tend to rise towards the end of the week as demand increases with more people preparing for weekend travel. This pattern is a microcosm of economic principles that apply to financial planning as a whole. By avoiding peak refueling times, such as Fridays, smart drivers can save money, which is a fundamental concept in financial planning—maximizing resources by minimizing unnecessary expenditures.

Practical Financial Planning Tips

Applying financial planning principles to your daily life can lead to significant savings over time. Here are some practical tips:

- Budgeting: Create a monthly budget that accounts for all expenses, including fuel costs. This helps identify areas where you can cut back.

- Monitoring Prices: Keep an eye on fuel prices throughout the week and refuel when prices are lower.

- Using Technology: Utilize apps that track fuel prices and alert you to the best times to refuel.

- Regular Maintenance: Ensure your vehicle is well-maintained to improve fuel efficiency, which can also save money in the long run.

These strategies not only apply to managing fuel costs but also to broader financial planning, reinforcing the importance of strategic decision-making.

Long-term Financial Benefits

Embracing a strategic approach to everyday expenses can lead to substantial long-term financial benefits. By consistently choosing to refuel on less expensive days, you can allocate saved funds to other financial goals, such as investing or debt reduction. This approach exemplifies the power of compound savings—small, regular savings that accumulate over time to create significant financial advantages. The discipline required to avoid refueling on Fridays translates into broader financial habits that emphasize foresight and planning, essential components of successful financial management.

Conclusion: The Bigger Picture of Financial Planning

In conclusion, the decision to avoid refueling on Fridays serves as a metaphor for the broader principles of financial planning. By understanding market dynamics and making informed decisions, individuals can optimize their financial resources, leading to enhanced savings and financial security. This mindset, when applied consistently across various aspects of life, supports the development of robust financial habits that are essential for achieving long-term financial goals. By integrating these practices into daily routines, individuals can ensure that they are not only saving money on fuel but also laying the groundwork for a financially secure future.